Outbound teams that hit quota consistently master two interconnected disciplines: prospecting and qualifying leads systematically. The gap between average and high-performing teams isn’t effort—it’s how to research sales leads efficiently and build a sales lead qualification process that scales without adding headcount.

Here’s what’s broken in most outbound motions: SDRs spend 15+ minutes researching leads that should take 3 minutes. Qualification criteria live in people’s heads, not in systems. The same company data gets researched dozens of times. And worst of all—teams don’t know which signals actually predict closed deals.

The single biggest lever? Automate your data collection layer completely, then rebuild qualification logic using closed-won data instead of assumptions.

This guide explains prospecting and qualifying leads in modern B2B outbound sales—with specific frameworks you can implement immediately.

What Prospecting and Qualifying Leads Actually Mean

Prospecting and qualifying leads are two distinct activities that determine which accounts enter your outbound motion and how effectively your team engages them.

Prospecting means identifying and researching potential customers who match your ideal customer profile. You’re building a list of companies and contacts worth pursuing.

Qualifying means evaluating whether those prospects are ready for outbound engagement based on fit, timing, and buying capacity. You’re filtering your list down to accounts your team should actually work.

When prospecting and qualifying leads work together systematically, SDRs confidently engage accounts that convert. When they’re broken, SDRs chase dead ends while real opportunities sit untouched.

The key insight: Effective prospecting and qualifying leads aren’t SDR skills to train—they’re operational infrastructure to build once and execute repeatedly.

Old vs. Modern Approaches to Prospecting and Qualifying Leads

The difference between legacy and modern outbound workflows is not tools or headcount. It is how prospecting and qualifying leads are designed. One relies on manual effort and individual judgment. The other relies on systems that remove guesswork and wasted motion. Here’s how each approach plays out in practice.

Legacy Approach

This model creates variability because prospecting and qualifying rely on individual judgment. As volume increases, inefficiency compounds instead of performance.

Manual everything: SDRs spend 15-20 minutes per lead gathering basic information from LinkedIn, company websites, and Crunchbase.

Subjective qualification: Each SDR develops their own mental model of “good fit.” Two SDRs looking at the same account reach opposite conclusions.

Assumptions-based criteria: Teams define ICP based on what they think should work, not what actually closes.

Modern Approach

This model scales because prospecting and qualifying are handled by systems, not people. SDRs engage only after data and qualification are already in place.

Automated data collection: Firmographics, technographics, and contact details append automatically when leads enter the system. SDRs review data, they don’t collect it.

Systematic qualification: A sales lead qualification process runs on explicit rules built from closed-won data. 90% of decisions are obvious and consistent.

Data-driven criteria: Teams analyze which attributes actually predict deals, then codify those patterns into scoring rules.

The fundamental difference? Legacy approaches treat prospecting and qualifying as SDR responsibilities. Modern approaches treat them as operational infrastructure.

Now let’s walk through the practical framework that eliminates wasted research time.

How to Research Sales Leads: The Enrich-First Framework

Traditional prospecting meant 15-20 minutes of manual research per lead. Modern prospecting and qualifying means defining what information matters, automating its collection, then reserving human judgment for context that can’t be automated.

Step 1: Define “Outbound-Ready” with Brutal Specificity

Before you research a single lead, answer: What information does an SDR need to personalize outreach and confirm fit?

For most B2B teams:

- Firmographics: Employee count, revenue range, industry, HQ location

- Technographics: Current tech stack—tools you integrate with or replace

- Contacts: Decision-makers mapped by function, seniority, and department

- Timing signals: Funding, leadership changes, product launches, hiring patterns

The difference between average and elite teams? Specificity.

“We need to understand the company” is useless.

“We need employee count within ±20%, current CRM platform, and whether they’ve hired SDRs in the past 90 days” is actionable.

Step 2: Automate Data Collection

Once you know what matters, pull that data at ingestion—not during research.

Company-level data should populate automatically when a lead enters your CRM, often through techniques like waterfall enrichment that reduce data gaps before SDRs ever engage.

Technology stack information should append during enrichment. Modern tools identify what software companies use.

Contact details need enrichment, too. Map contacts by function, seniority, and department. This tells SDRs who to approach and in what sequence.

Timing signals should trigger alerts automatically. When a target account raises funding or promotes a new executive, that context should surface without manual searches.

The principle: Automate 80% of data collection. Reserve 20% for SDR judgment on messaging angles.

Step 3: Focus Human Research on What Machines Can’t Find

If enrichment provides company size, industry, and tech stack, SDRs shouldn’t re-research those details.

Focus research on:

- Recent company activity: Product launches, funding rounds, market expansion

- Individual context: Recent LinkedIn posts, role changes, published content

- Account-specific pain signals: Evidence they’re struggling with problems you solve

Real Example: Researching an Inbound Demo Request

A demo request comes in from a Marketing Director at a 300-person SaaS company.

What happens automatically:

- System enriches: 280 employees, $40M ARR, Series B funded, Austin HQ

- Tech stack appends: Salesforce CRM, HubSpot Marketing, Outreach

- Contact mapped: Marketing Director, mid-level, leads 12-person team

- Signals surface: Hired 3 SDRs in past 60 days, posted VP of Sales role

An SDR opens this lead and immediately knows: mid-market company in ICP, uses complementary tools, actively scaling sales team.

Research time: 90 seconds to review.

Time to personalize outreach: 3 minutes.

That’s modern prospecting and qualifying leads in action—data flows automatically, SDRs focus on messaging.

Takeaway: When enrichment handles 80% of data collection, SDRs spend time on personalization that actually drives meetings, not basic company research.

Once your prospecting infrastructure handles data collection, the next step is ensuring only qualified accounts consume SDR capacity.

How to Build a Sales Lead Qualification Process That Scales

Your sales lead qualification process breaks when criteria live in someone’s head. It scales when you codify logic, automate first-pass decisions, and create feedback loops based on revenue outcomes.

Build Qualification Criteria from Closed Deals

Most teams define qualified leads based on what they think should work. High-performing teams pull criteria from what actually works.

Run this analysis quarterly:

- Pull your last 100 closed-won deals

- Identify common attributes: company size, industry, tech stack, deal size

- Look for patterns: Do certain industries close faster? Do specific tools predict higher ACV?

- Map the attributes that predict success

If 80% of closed deals come from companies with 100-500 employees in B2B SaaS using Salesforce, those attributes define “qualified.”

Structure Qualification as Rules

“Good fit” is subjective and doesn’t scale. “Meets 4 of 5 ICP criteria” is measurable.

Define your sales lead qualification process as binary checks:

- Company size: 100–2,000 employees (Yes/No)

- Industry: B2B SaaS or FinTech (Yes/No)

- Tech stack: Uses Salesforce, HubSpot, or Dynamics (Yes/No)

- Geography: North America or UK (Yes/No)

- Funding stage: Series A+ or $10M+ ARR (Yes/No)

A lead that checks 4+ boxes qualifies. Fewer than 3 gets disqualified.

Automate First-Pass Qualification

If a lead objectively doesn’t fit your ICP, filter it before it reaches an SDR.

Build qualification rules at ingestion:

- Leads under 50 employees → auto-disqualify

- Leads outside North America/Europe → route to partner team

- Leads in excluded industries → remove from active queue

Takeaway: Automated qualification upstream protects SDR capacity—they work accounts where judgment matters, not accounts that obviously don’t fit.

Real Example: Qualifying a List Upload

You upload 5,000 companies from a conference.

What happens automatically:

- System enriches all 5,000 records

- Qualification rules run:

- 2,100 too small → disqualified

- 800 excluded industries → disqualified

- 400 outside geographies → routed to partners

- 1,700 meet ICP → move to SDR review

SDRs work 1,700 qualified accounts instead of 5,000 random contacts. Research time drops from 15 minutes to 3 minutes per account because prospecting and qualifying leads happen systematically, not manually.

Understanding when to apply these rules—before or after prospecting—depends on your context.

When to Qualify Before Prospecting vs. After

The sequence matters when structuring your prospecting and qualifying workflow.

Qualify First When:

- Your ICP is clearly defined (90%+ enrichment rate)

- You’re running high-volume outbound

- You have reliable intent data to score leads automatically

Why: Reduces wasted effort. SDRs only touch accounts that meet baseline criteria.

Prospect First When:

- You’re testing a new market

- Data sources have gaps

- You’re running ABM plays where every account gets personalized research

Why: Gives flexibility but requires discipline.

Hybrid Approach (Most Common):

- Lead enters → enrichment runs automatically

- First-pass qualification on firmographics/technographics → 60% disqualify

- Remaining 40% route to SDRs with full context

- SDRs review timing signals → another 20% disqualify

- Final 20% enter sequences with strong personalization

This balances automation with judgment and is how most teams handle prospecting and qualifying leads at scale.

Takeaway: Match your qualification sequence to your ICP clarity and data coverage—there’s no universal “right” answer, only what fits your current go-to-market motion.

Now let’s map the complete operational workflow.

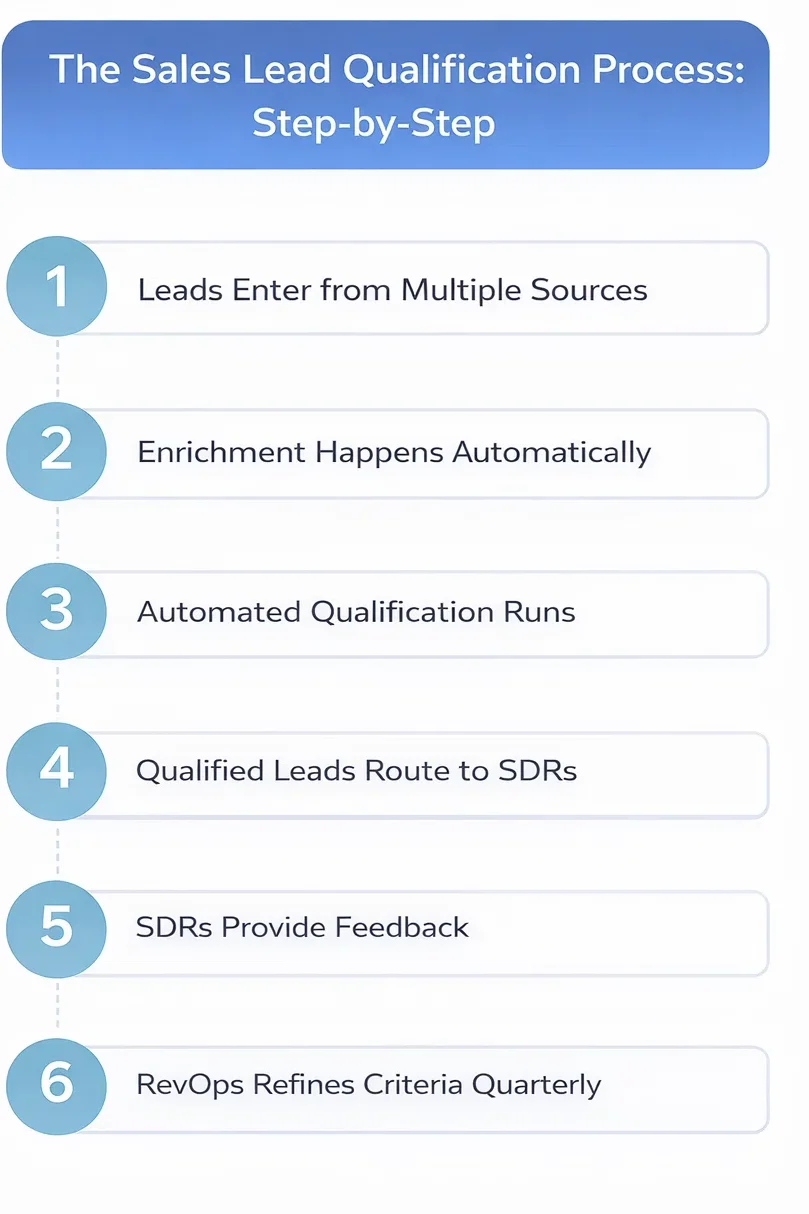

The Sales Lead Qualification Process: Step-by-Step

A scalable sales lead qualification process follows a defined sequence, not individual intuition. Each step ensures only outbound-ready leads consume SDR time.

Step 1: Leads Enter from Multiple Sources

Form fills, intent providers, list uploads, and event registrations hit your CRM.

Step 2: Enrichment Happens Automatically

Company data, contact info, technographics, and intent signals are appended within seconds.

Step 3: Automated Qualification Runs

System evaluates leads against ICP criteria. Leads that fail baseline checks get routed out immediately.

Step 4: Qualified Leads Route to SDRs

SDRs receive leads with complete data. They review for 2-3 minutes and launch sequences.

Step 5: SDRs Provide Feedback

Track why leads were disqualified: wrong size, wrong role, bad timing, no budget.

Step 6: RevOps Refines Criteria Quarterly

Compare qualification decisions to closed-won outcomes. Adjust rules based on revenue data.

This creates a feedback loop that improves targeting accuracy over time. At scale, prospecting and qualifying leads must align with data governance and privacy standards such as GDPR and CCPA to maintain trust and consistency.

Takeaway: A systematic sales lead qualification process turns prospecting and qualifying from art into science—decisions become predictable, consistent, and tied directly to revenue outcomes.

With systematic qualification in place, optimize how SDRs allocate research time.

How to Research Sales Leads Without Wasting Time: The 3-Tier Model

Most SDRs waste time opening 4-5 tabs per lead. Learning how to research sales leads efficiently means time-boxing research by lead source.

The 3-Tier Research Model

Tier 1: Warm Inbound (2-3 minutes)

Demo requests, trial signups. They’ve shown intent—focus on personalization.

Tier 2: Intent Signals (5 minutes)

Downloaded content, visited multiple pages. Confirm fit and understand what triggered interest.

Tier 3: Cold Outbound (7-10 minutes)

List uploads, conference attendees. Deeper research needed to establish relevance.

Modern AI sales tools now help teams automate research and surface personalization signals without increasing SDR workload.

Focus on What’s NOT in Your Data

This is the critical shift in modern prospecting and qualifying: automate data collection, reserve human time for insight.

Research:

- Recent activity: Product launches, funding, leadership changes

- Individual context: LinkedIn posts, role changes, published content

- Pain signals: Evidence they’re struggling with problems you solve

Use Templates to Structure Research

Create a standard format:

- Company trigger: Why now? (e.g., “Raised Series B”)

- Contact trigger: Why this person? (e.g., “New VP Sales”)

- Personalization hook: What angle connects your solution to their situation?

Takeaway: Tiering research effort by lead source prevents over-investing in cold prospects and under-investing in high-intent opportunities—prospecting and qualifying efficiency compounds when effort matches probability.

Even with efficient research, most teams fall into predictable traps.

Common Mistakes That Kill Efficiency

Mistake 1: Researching the Same Data Manually

SDRs check company headcount 50 times per week because enrichment doesn’t happen automatically.

Fix: Enrich at ingestion. If research exceeds 10 minutes per lead, your data infrastructure is broken.

Mistake 2: Qualifying on Gut Feel

Two SDRs look at the same account and reach opposite conclusions.

Fix: Define explicit qualification rules from closed-won data. 90% of decisions should be obvious.

Mistake 3: Assigning Leads Before They’re Ready

SDRs receive incomplete records and waste time enriching manually.

Fix: Enrich and qualify upstream. Every lead should be ready to work immediately.

Mistake 4: Ignoring What Actually Converts

You never compare “qualified” leads to closed deals.

Fix: Run quarterly reviews comparing qualification to pipeline data. Refine based on what wins.

Mistake 5: Treating All Leads Identically

A warm MQL doesn’t need the same depth as a cold prospect.

Fix: Use the 3-Tier Research Model. Tier effort based on source and intent.

Takeaway: Most prospecting and qualifying problems aren’t people problems—they’re infrastructure problems disguised as execution issues.

Knowing what not to do matters, but measuring whether your process works requires the right indicators.

Many of these issues show up repeatedly across teams and are well documented as common SDR prospecting mistakes, especially when systems fail to support execution.

6 Metrics That Show If Your Process Works

1. Research Time Per Lead

Target: Under 5 minutes for qualified leads, under 10 for cold outbound.

2. Qualification Consistency Rate

Target: 85%+ agreement when different SDRs evaluate similar accounts.

3. Disqualification Rate by Source

Target: Under 20% post-assignment disqualification.

4. Qualified-to-Meeting Conversion

Target: 8-15% for outbound, 25-40% for inbound.

5. Time to First Touch

Target: Under 24 hours for inbound, under 48 for outbound.

6. Override Rate

Target: Under 10% when SDRs override automated qualification.

These metrics reveal whether your prospecting and qualifying leads process scales or depends on individual hustle.

Takeaway: If research time climbs above 10 minutes or disqualification rates exceed 20%, you’re treating symptoms (SDR performance) instead of the root cause (broken infrastructure).

Even the best workflows require the right technology foundation.

Tools That Support Scalable Prospecting and Qualifying

You don’t need a dozen tools. You need infrastructure that automates data collection, applies qualification logic systematically, and ensures every lead reaches SDRs ready to work.

For Enrichment: Platforms like Pintel, Clearbit, ZoomInfo, or Cognism append firmographic and technographic data automatically at ingestion. The key is that enrichment happens in seconds, not days.

For Qualification and Workflow Orchestration: Purpose-built platforms eliminate the manual steps that slow teams down. Pintel, for example, ingests leads from multiple sources, enriches them with firmographic and technographic data, applies your qualification logic automatically, and routes only outbound-ready leads to SDRs—turning prospecting and qualifying from a 15-minute manual process into a 3-minute review. This infrastructure approach ensures your sales lead qualification process runs consistently regardless of SDR turnover or workload.

For Workflow Automation: Use native CRM automation (Salesforce Flow, HubSpot Workflows) or Zapier to route qualified leads, trigger enrichment sequences, and update fields based on qualification rules. Automation handles repetitive logic so RevOps can focus on refining criteria.

For Deep Research: LinkedIn Sales Navigator, Pintel, Apollo, and Clay supplement enrichment for high-value accounts. Reserve these for strategic prospects where extra context justifies the time investment—they should be exceptions, not your default research method.

The Principle: Automate 80% of prospecting and qualifying work, personalize the final 20%. The best tools handle infrastructure so SDRs can focus on what machines can’t do—judgment, context, and messaging that drives meetings.

Takeaway: Tools don’t fix broken workflows—they scale good ones. Build your prospecting and qualifying process first, then layer in technology that removes manual bottlenecks.

With the right tools and handling infrastructure, your team focuses on intelligent execution.

Final Takeaway: Build Systems, Not Heroics

Prospecting and qualifying aren’t SDR skills to train—they’re operational systems to build.

When you automate data collection, codify qualification rules using closed-won data, and build feedback loops that refine targeting, your outbound motion becomes predictable.

The single biggest mistake? Treating prospecting and qualifying as hiring problems instead of infrastructure problems. You can’t hire your way out of broken workflows.

What to do tomorrow:

- Audit your last 50 closed deals. Identify 3-5 common attributes. Build qualification rules around those patterns.

- Measure how long SDRs spend researching leads. If over 10 minutes, fix enrichment before adding headcount.

- Track disqualification rates by source. Kill sources where 30%+ disqualify post-assignment.

There’s no single “correct” structure—only the one aligned with how you generate revenue. Whether building your first outbound motion or scaling to 50+ SDRs, start by understanding where pipeline comes from, where it slows down, and which systems unlock growth.

Efficient prospecting and qualifying determines whether your outbound motion scales predictably or stalls under its own weight.

Frequently Asked Questions About Prospecting and Qualifying Leads

What does prospecting and qualifying leads mean in outbound sales?

Prospecting and qualifying leads means identifying potential customers and systematically evaluating whether they match your ICP, have buying intent, and should enter your outbound workflow.

What is a sales qualification process?

A sales qualification process is a rules based system that determines which leads are ready for outreach based on company fit, timing signals, and revenue potential.

How are prospecting and qualifying leads different?

Prospecting focuses on finding and researching accounts, while qualifying determines whether those accounts should be worked now based on fit and readiness.

Who owns prospecting and qualifying leads in modern GTM teams?

In modern GTM teams, RevOps owns the prospecting and qualifying leads framework, while SDRs execute using enriched data and predefined qualification rules.

Why do prospecting and qualifying leads break at scale?

Prospecting and qualifying leads fail when data collection is manual and qualification decisions rely on SDR judgment instead of a structured sales qualification process.