Why Most Prospecting Playbooks Are Already Obsolete

BDR prospecting feels harder than it used to. Activity is higher, tools are more advanced, and teams are putting in the effort, yet response rates and pipeline quality are not improving the way they should.

The issue isn’t execution or effort. Most prospecting playbooks were designed for a time when lists stayed stable, research was quick, and volume alone could drive meetings. Today, buyer roles are less predictable, data decays faster, and reaching the right account requires more context and timing than those workflows were built to handle.

This post explains what modern BDR prospecting looks like when those assumptions no longer hold, and what needs to change for teams to build a consistent pipeline today.

What Is Modern Prospecting?

Modern prospecting is a system-driven workflow where qualification, timing, and data enrichment happen before outreach — not during or after it.

Unlike traditional linear prospecting (list → research → email → hope), the modern BDR prospecting workflow operates in layers:

- Stable ICP definitions that don’t shift every quarter

- Automated data enrichment to eliminate manual research bottlenecks

- Signal-based timing that triggers outreach when prospects are actually ready

- Pre-qualification filters that ensure only high-fit leads enter sequences

- Structured handoffs with full context for AEs

The result: fewer touches, higher reply rates, better pipeline quality.

If your team is still running on activity metrics and manual list-building, you’re not behind on tactics — you’re running the wrong playbook entirely.

What Prospecting Looked Like Before — and Why It No Longer Works

Most teams are still running the same linear playbook from five years ago.

The Old Linear Prospecting Model

It looked like this: pull a static list (usually from your CRM or a data vendor), research 10-15 accounts manually, write personalized emails, send sequences, hope for replies.

This worked when companies had 1-2 buying personas, titles actually meant something consistent, and you could reach decision-makers with cold email alone.

Where This Model Breaks at Scale

The moment your outbound team grows past 3 BDRs, you hit these walls:

Data decay: 30% of B2B contact data goes stale every year. Job changes, role shifts, company acquisitions — your “clean” list is dirty in 90 days.

Segment drift: Your ICP today isn’t your ICP next quarter. Manual list pulls can’t keep up with changing qualification criteria.

Research time explosion: BDRs spend 60-70% of their day researching, not prospecting. Manual LinkedIn stalking doesn’t scale to 500 accounts/week.

Poor handoffs: AEs get “qualified” leads that were never actually qualified. No feedback loop to improve targeting.

Most teams respond by adding more tools. That just creates more data chaos.

The solution isn’t more activity or better copywriting. It’s rebuilding the BDR prospecting workflow from the ground up.

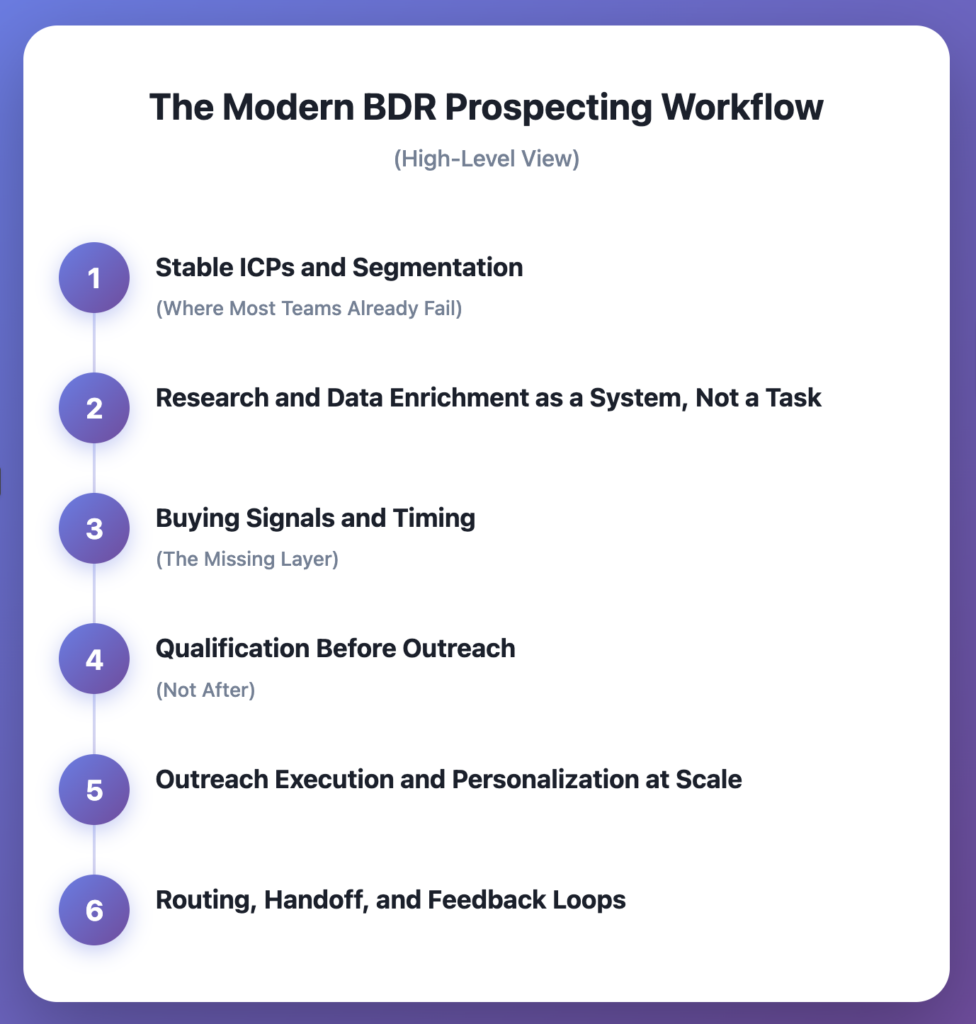

The Modern BDR Prospecting Workflow (High-Level View)

Modern BDR prospecting isn’t linear anymore. It’s system-driven.

Here’s the actual flow in Teams that consistently hits pipeline targets:

Quick Reference: The 5-Layer Modern BDR Playbook

Layer 1: ICP Stability → Firmographics + technographics + behavioral markers → 3-5 segments max, not 47 micro-segments

Layer 2: Data as a System → Waterfall enrichment (primary → secondary → manual flag) → Validation every 60-90 days

Layer 3: Signal-Based Timing → Wait for 2-3 stacked signals before outreach → High-confidence signals: funding, executive hires, tech changes

Layer 4: Pre-Qualification → Seniority + function + context checks before sequences → Cuts wasted outreach by 60-70%

Layer 5: Clean Handoffs → Automated routing with full context notes → Feedback loops to refine ICPs and signals quarterly

This framework is what separates teams that scale from teams that just send more emails.

Let’s go deeper into each layer.

Step 1: Stable ICPs and Segmentation (Where Most Teams Already Fail)

If your ICP changes every month, BDR prospecting will always feel broken.

The Problem with Marketing ICPs

Marketing ICPs are broad: “Mid-market SaaS companies with 50-500 employees.”

That’s not an outbound ICP. That’s a wish list.

What an Outbound ICP Actually Needs

Your ICP for a BDR prospecting workflow needs firmographics you can verify (company size, revenue, industry), technographic signals (current tech stack like “uses HubSpot but no enrichment tool”), and behavioral markers (hiring patterns, funding events, expansion signals).

Example of a workable outbound ICP: Series B–C SaaS, 100–300 employees, using Salesforce + Outreach, recently posted a BDR or SDR Manager role, no data enrichment tool in their stack.

Why Over-Segmentation Kills Throughput

Some teams build 47 micro-segments thinking it’ll improve personalization.

What actually happens: BDRs spend all their time managing segments, sample sizes get too small to learn anything, and messaging becomes impossible to test.

Start with 3-5 segments max. Expand only when you’ve saturated them.

Once your ICP is stable, you need a system to keep your data clean without manual work.

Step 2: Research and Data Enrichment as a System, Not a Task

If your BDRs are spending 20 minutes per lead on LinkedIn, you don’t have a prospecting process — you have an expensive research team.

What “Good Data” Actually Means for Outbound

Good data for modern BDR playbooks includes contact accuracy (verified emails, not scraped guesses), contextual data (tech stack, recent hiring, funding status), and enrichment recency (data refreshed in the last 30-60 days, not 18 months ago).

Waterfall Enrichment Logic

High-performing teams don’t use one data source. They use 3-4 in sequence: check primary vendor (e.g., Pintel Apollo, ZoomInfo), if contact is missing or stale → waterfall to secondary source, if still incomplete → flag for manual research or skip.

This means you’re not paying for redundant data, your BDRs aren’t wasting time on dead ends, and coverage stays high without manual work.

Validation vs. Enrichment

Enrichment = adding new data fields (technographics, intent signals). Validation = confirming existing data is still accurate.

Most teams enrich constantly but never validate. Then they wonder why bounce rates are 30%.

Run validation checks every 60-90 days on your active prospecting lists.

Where Automation Fits — and Where It Doesn’t

Automate: data enrichment, email validation, basic firmographic checks.

Don’t automate: ICP definition, buying signal interpretation, actual qualification decisions.

Clean data gets you in the door. Timing gets you the meeting.

Step 3: Buying Signals and Timing (The Missing Layer)

Relevance beats personalization. Timing beats both.

Why Most Teams Ignore Timing

The standard outbound prospecting workflow looks like this: pull list, send sequence, wait.

There’s no concept of readiness. You’re just hoping you hit someone at the right moment.

Modern teams don’t hope. They wait for signals.

Types of Usable Signals

High-confidence signals: Funding announcement, executive hire (especially GTM roles), tech stack change, expansion (new office, new region)

Medium-confidence signals: Job postings for relevant roles, content engagement, website visits to pricing or comparison pages

Low-confidence signals: Generic intent data, conference attendance, LinkedIn profile updates

Why Most Signals Are Noisy

Just because someone visited your website doesn’t mean they’re ready to buy.

The trick is signal stacking — waiting for 2-3 signals before triggering outreach: job posting for a RevOps lead + tech stack gap + recent funding = outreach-ready. One LinkedIn visit = not ready.

How Teams Decide When a Lead Is “Outreach-Ready”

In a functional BDR research automation setup, signals get logged automatically (via intent tools, CRM alerts, job board scrapers), leads hit a threshold (e.g., “2+ high-confidence signals in 30 days”), and they enter an outreach queue — already qualified, already timed.

This is why modern BDR prospecting feels less like cold outreach and more like warm follow-up.

But even with perfect timing, you’re still wasting sequences if you’re reaching out to the wrong people.

Step 4: Qualification Before Outreach (Not After)

Modern teams qualify leads before the first message, not after the first reply.

The Old Way: Qualify After Response

Old sales prospecting workflow: send cold email to 1,000 people, get 20 replies, realize 15 aren’t actually qualified, hand off 5 to AEs.

That’s a 0.5% conversion rate on your total effort.

The New Way: Qualify Before Outreach

New BDR prospecting workflow: filter 1,000 leads down to 200 based on ICP fit + signals, send to those 200, get 15 replies, 12 are qualified, hand off 12 to AEs.

That’s a 6% conversion rate — and your AEs aren’t annoyed.

Qualification Criteria Beyond Title and Company Size

Basic filters (title, company size) are table stakes.

Add these layers:

Seniority check: Are they a decision-maker, influencer, or end-user? Do they control budget or just recommend vendors?

Function check: Does their day-to-day actually involve the problem you solve? Example: Don’t pitch sales enablement to a VP of Sales Ops who only touches CRM architecture.

Context check: Do they have the surrounding infrastructure to use your product? Example: Don’t pitch a Salesforce app to a HubSpot-only shop.

How This Reduces Wasted Sequences

Pre-qualification cuts sequence waste by 60-70% in most teams.

Every unqualified lead in a sequence means wasted email sends, follow-ups, and hits to your domain reputation — all while your BDR isn’t focusing on real prospects.

Now your list is clean, timed, and qualified. Outreach is the easy part.

Step 5: Outreach Execution and Personalization at Scale

Personalization isn’t handcrafted anymore — it’s structured.

What “Good Enough” Personalization Looks Like

You don’t need to reference someone’s college rowing team to book a meeting.

Good enough personalization in an outbound personalization at scale system:

Segment-level relevance: “I saw you’re hiring SDRs” (based on job posting signal)

Role-specific pain: “Most RevOps leaders we work with struggle with data hygiene” (based on title)

Contextual timing: “Now that you’ve raised your Series B…” (based on funding signal)

That’s 90% as effective as deep research, at 5% of the time cost.

A Real Example of Signal-Based Outreach

Below is what structured, signal-based personalization actually looks like in practice.

Signals detected: Series B funding announced 3 weeks ago, job posting for a RevOps Manager, Salesforce + Outreach in tech stack

Email example:

Subject: RevOps scale after Series B

Hi {{First Name}},

Saw you recently raised your Series B and are hiring a RevOps Manager.

Teams at this stage often find their prospecting data and routing logic start breaking as outbound volume increases. Clean enrichment and timing usually become bigger bottlenecks than messaging itself.

Curious how you’re handling data validation and lead qualification today as the team scales.

Worth a quick conversation if this is on your radar.

{{Signature}}

This message works not because it’s clever, but because it’s timely, relevant, and grounded in real signals. No deep LinkedIn research. No personal trivia. Just clear context, role relevance, and correct timing.

Where Templates Still Work

Templates get a bad rap. But they work when they’re built for a specific segment, reference real signals or context, and are tested and iterated based on data.

What doesn’t work: one template for all segments, no signal or context hooks, “just touching base” garbage.

Why Message Relevance Depends on Upstream Data Quality

If your data is bad, your messaging will be irrelevant — no matter how clever the copy.

Example: Your template says “I noticed you use Salesforce” but they switched to HubSpot 6 months ago. Instant delete.

This is why upstream data quality and signal detection matter so much. Clean data drives relevant messaging.

Getting replies is only half the battle. Handoffs are where most pipeline leaks.

Step 6: Routing, Handoff, and Feedback Loops

Prospecting doesn’t end at reply — it ends at a clean handoff.

Routing Logic Basics

In a functional RevOps prospecting system, leads route based on segment, region, or deal size, routing rules are documented and automated, and AEs know exactly what to expect when they get a lead.

Manual routing = chaos. Automated routing = scalable.

Common Handoff Failures

The “warm intro” that isn’t: BDR books a meeting with someone who wasn’t actually qualified. AE shows up, realizes it immediately. Trust between BDR and AE erodes.

The context gap: BDR hands off a lead with zero notes. AE has no idea what pain points came up in the conversation. Call starts from scratch, prospect gets annoyed.

The timing failure: BDR books a meeting for 2 weeks out. Prospect’s urgency fades. Meeting gets canceled or no-showed.

Why Feedback Loops Matter for Improving ICPs and Signals

Most BDR prospecting teams operate in a vacuum. They never hear which leads actually closed, which ICPs converted best, or which signals were predictive vs. noise.

Without feedback, ICP segmentation for outbound never improves, signal thresholds stay guesswork, and messaging never evolves.

What a functional feedback loop looks like: set up a monthly sync between BDRs, AEs, and RevOps to review win/loss data by segment, signal quality by type (which signals actually predicted pipeline?), and common objections by ICP.

Example in action: BDRs notice that “recent funding” signals have a 40% meeting-to-opp conversion rate. “Job posting” signals only convert at 15%. Team adjusts signal thresholds: funding gets higher priority, job postings get deprioritized.

Use that data to refine your BDR prospecting workflow every quarter. This turns prospecting from guesswork into a learning system.

So what does this all mean for your team?

What This Means for BDR Teams

The BDR role is becoming more operational, not more manual.

Shift from List Builders to Workflow Operators

Old BDR job description: build lists, send emails, book meetings.

New BDR job description: monitor signal queues, validate enrichment outputs, execute timed outreach, feed qualification data back to RevOps.

The skill set is shifting from “hustle and research” to “systems and execution.”

Understanding data quality and enrichment logic, signal interpretation, CRM and automation tool fluency, and structured note-taking for handoffs matter more. Manual LinkedIn research marathons, writing 10 variations of the same cold email, and activity volume for volume’s sake matter less.

What Teams Should Stop Measuring (Raw Activity)

If you’re still tracking “emails sent per day” as a primary KPI, you’re measuring the wrong thing.

Better metrics: qualified pipeline created (not just meetings booked), lead-to-opp conversion rate (are your handoffs clean?), signal-to-response rate (are your triggers accurate?), ICP match rate (are you prospecting into the right accounts?).

Activity is a lagging indicator. Quality is the leading one.

Before you rebuild your whole workflow, here’s when this actually makes sense.

When This Workflow Makes Sense — and When It Doesn’t

Not every team needs this level of systemization.

Early-Stage vs. Scaling Teams

If you’re pre-product-market fit: Your ICP is still shifting. You need high-touch, exploratory conversations. Manual research and custom outreach still make sense.

If you’re scaling (10+ BDRs, defined ICP, repeatable motion): Volume demands automation. Consistency matters more than creativity. This workflow becomes necessary.

Where Manual Still Works

Manual BDR prospecting still works when your TAM is under 500 accounts, deal sizes are $100K+ and require deep research, or you’re selling into a niche with very specific personas.

In those cases, BDRs should still spend 30-40% of their time on deep account research.

When Automation Becomes Necessary

Automation becomes non-negotiable when you’re prospecting into 1,000+ accounts per quarter, your BDRs are spending more than 50% of their time on research and data hygiene, or your AEs are complaining about lead quality or handoff context gaps.

At that point, manual workflows are the bottleneck — not a feature.

Prospecting Isn’t Broken — Outdated Workflows Are

Let’s go back to the start.

Your BDRs aren’t underperforming because they lack effort. They’re underperforming because they’re operating in a system designed for a different era.

The modern BDR prospecting workflow replaces activity-driven prospecting with quality-driven execution:

- Stable ICPs that don’t shift every quarter

- Automated enrichment so BDRs aren’t researchers

- Signal-based timing so outreach is relevant, not random

- Pre-qualified leads so sequences aren’t wasted

- Clean handoffs so AEs can actually close

This isn’t theory. This is how functional outbound teams operate.

If your team is still running the old playbook — static lists, manual research, spray-and-pray sequences — the problem isn’t your people.

It’s the workflow.

Fix the system. The results will follow.

Frequently Asked Questions

What is a modern BDR prospecting workflow?

A modern BDR prospecting workflow is a system-driven process where ICP definition, data enrichment, signal detection, and qualification happen before outreach — not during or after. It replaces manual research and spray-and-pray sequences with automated, signal-based timing and pre-qualified lead routing.

How is modern prospecting different from traditional outbound?

Traditional outbound is linear: pull a list, research manually, send sequences, and hope. Modern BDR prospecting is layered: stable ICPs, automated enrichment, signal-based triggers, pre-qualification filters, and feedback loops that continuously improve targeting and messaging.

What are buying signals in BDR prospecting?

Buying signals are events or behaviors that indicate a prospect may be ready to engage. High-confidence signals include funding announcements, executive hires, tech stack changes, and expansion activities. Modern teams use “signal stacking” — waiting for 2-3 signals before triggering outreach to improve relevance and timing.

Why does manual prospecting not scale?

BDRs spend 60-70% of their time on research when prospecting manually. At scale (10+ BDRs, 1,000+ accounts per quarter), this creates bottlenecks, data decay, inconsistent quality, and wasted sequences on unqualified leads. Automation becomes necessary to maintain throughput and quality.

What is ICP segmentation for outbound?

ICP segmentation for outbound means defining 3-5 stable prospect segments based on firmographics (company size, revenue), technographics (current tech stack), and behavioral markers (hiring patterns, funding events). Over-segmentation (20+ micro-segments) kills throughput and makes testing impossible.

How do modern teams qualify leads before outreach?

Modern teams use pre-qualification filters that check seniority (decision-maker vs. end-user), function (does their role involve the problem you solve?), and context (do they have the infrastructure to use your product?). This happens before the first email, reducing wasted sequences by 60-70%.

What is waterfall enrichment in a BDR prospecting workflow?

Waterfall enrichment is a multi-source data strategy where you check a primary vendor first, then fall back to secondary sources if data is missing or stale, and flag for manual research only as a last resort. This keeps data coverage high without redundant costs or manual bottlenecks.

When should a BDR team automate prospecting?

Automation becomes necessary when you’re prospecting into 1,000+ accounts per quarter, BDRs spend more than 50% of their time on research and data hygiene, or AEs consistently complain about lead quality and handoff context gaps. At that scale, manual workflows become the bottleneck.