Strong outbound motions start with deciding which accounts deserve attention.

Teams use a growing stack of account research tools, data providers, enrichment platforms, and intent signals to support that decision. But not all tools play the same role in how accounts are evaluated and qualified.

Account research is the step where teams decide whether an account should move forward at all. The right account research tools don’t just surface information. They enforce consistency in how accounts are qualified before outreach begins.

This guide breaks down the top account research tools, explains what each is designed to do, and helps outbound teams choose the right solution based on decision enforcement, not data volume.

What Account Research Actually Means in Outbound

Account research in outbound is the process of deciding whether a company should be targeted before outreach begins.

It evaluates account fit and readiness, not contacts or data completeness.

In practice, account research answers three questions:

- Does this company match our ICP?

- Are there signals that indicate it is worth engaging now?

- Should this account enter outbound workflows at all?

If those questions are not answered explicitly, outbound activity is based on assumptions rather than qualification.

Why Most Account Research Tools Don’t Solve the Real Problem

Most account research tools focus on providing data, not making targeting decisions.

- Data providers show which companies exist

- Enrichment tools fill missing fields

- Manual research tools support individual investigation

None of these determine whether an account should be targeted or enforce that decision consistently across a team.

As a result, account qualification varies by rep, pipeline quality becomes unpredictable, and teams mistake activity for progress.

Account Research Tools by Function

Before evaluating specific account research tools, it helps to understand what role each plays in the account research process.

Account-readiness platforms enforce qualification logic before accounts enter outbound. They ingest data from multiple sources, apply your ICP criteria, evaluate readiness signals, and prepare accounts that meet your standards. This is the gatekeeping layer.

Data providers supply firmographic, technographic, and contact information. They’re essential for coverage but don’t make targeting decisions. They answer “what data exists?” not “which accounts should we target?”

Manual research tools help individuals investigate specific accounts in depth. They’re useful for high-value situations but don’t standardize research across teams or scale judgment.

Enrichment and automation layers fill gaps in CRM data and connect systems. They improve data hygiene and workflow efficiency but don’t determine account readiness.

Most teams need multiple categories of account research tools. The mistake is expecting one tool to handle account-readiness enforcement when it’s designed to do something else.

Top Account Research Tools for B2B Sales

The tools below are grouped by function and evaluated based on how they support account research and targeting decisions in real B2B sales workflows.

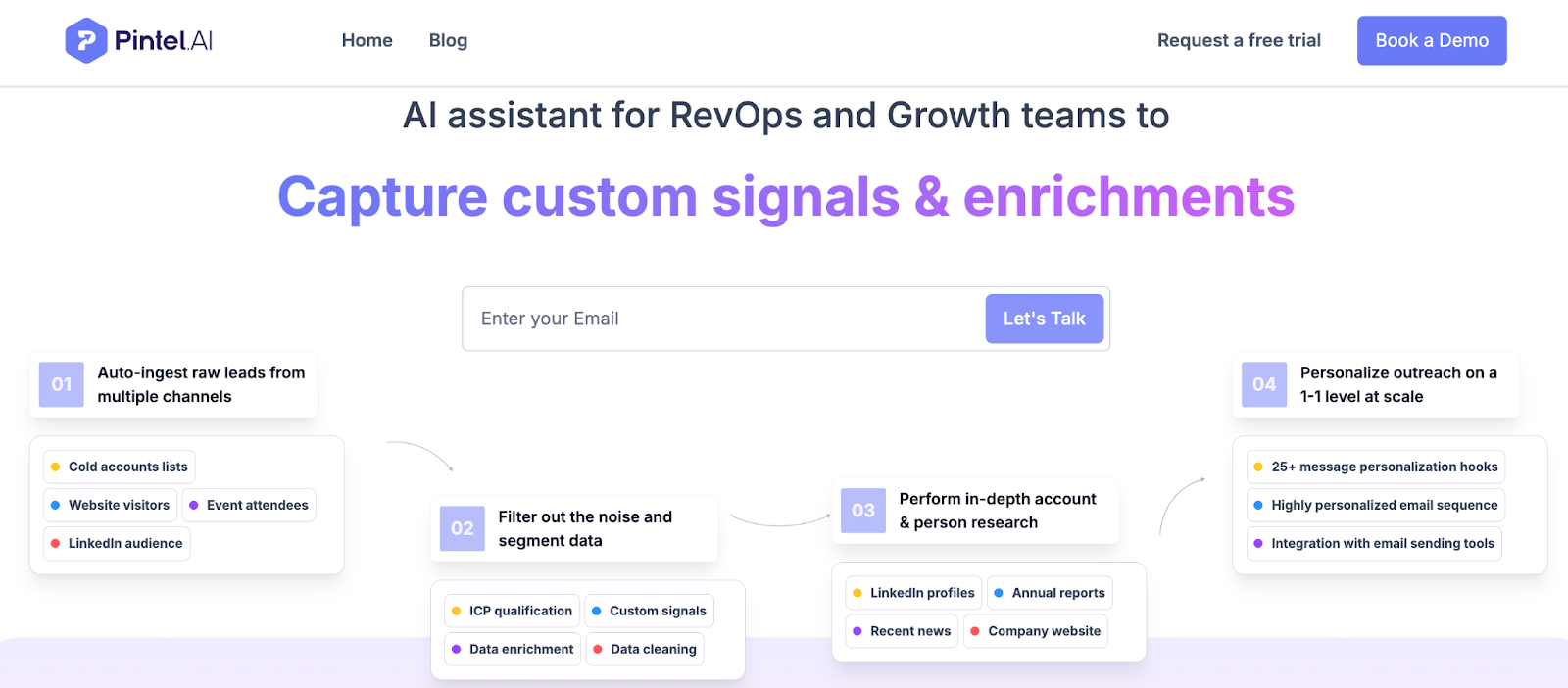

Pintel.AI

Pintel.AI pulls account data from your existing tools—CRM, data providers, intent platforms—and runs it through your qualification criteria automatically. Instead of reps manually deciding which accounts to target, Pintel.AI applies your ICP filters, enriches missing data, scores readiness signals, and hands over accounts that are already vetted and prepped.

The practical impact: your team stops wasting time on accounts that don’t fit. When one rep spends 20 minutes researching a company that fails basic ICP criteria, or another rep skips research entirely and emails anyone with a VP title, pipeline quality suffers. Pintel.AI removes that variance by doing the evaluation work upfront, the same way for every account.

What it does:

- Ingests data from multiple sources (CRM, intent tools, web data)

- Applies your ICP criteria automatically—company size, industry, tech stack, growth signals

- Enriches accounts with context your team needs for personalization

- Scores and prioritizes accounts based on readiness indicators

- Delivers research-ready accounts directly into your outbound workflow

Key capabilities:

- Custom qualification rules based on your specific ICP

- Automated enrichment that fills gaps without manual work

- Account scoring that prioritizes high-fit targets

- Workflow integration with your CRM and sales engagement tools

- Context delivery so reps know why each account was selected

Best for:

- Teams with defined ICP criteria that aren’t being applied consistently

- Organizations where account quality varies by who did the research

- Sales leaders dealing with complaints about unqualified pipeline

- Growing teams where manual research can’t keep up with volume

Pintel.AI scales from small teams just establishing their outbound motion to enterprises running complex multi-segment targeting. The deciding factor isn’t team size—it’s whether inconsistent account research is costing you pipeline quality.

ZoomInfo

ZoomInfo is a data provider. It supplies contact information, firmographics, technographics, and intent signals for millions of companies. Most B2B teams use it because coverage is comprehensive and data quality is reliable.

What ZoomInfo provides for account research:

- Firmographic data to filter accounts by size, industry, revenue, employee count

- Technographic signals showing what tools and systems companies use

- Intent data indicating web activity and potential buying signals

- Contact databases with direct dials and verified email addresses

- Organizational charts showing company structure and decision-makers

Where it fits in account research: ZoomInfo is the input layer. It gives you the raw data needed to identify potential accounts and understand their characteristics. What it doesn’t do is determine which accounts are actually qualified or ready for outreach. You can pull a list of 10,000 companies matching your firmographic criteria, but ZoomInfo won’t tell you which 200 are worth targeting first.

It’s essential for coverage but insufficient for account-readiness enforcement. Teams using only ZoomInfo still need a separate process to evaluate accounts, apply ICP logic, and prepare them for outbound—otherwise, reps are left making individual targeting decisions without standardized criteria.

Best for:

- Teams needing comprehensive contact and company data

- Organizations building account lists based on firmographic filters

- Sales teams requiring verified contact information at scale

Clearbit

Clearbit is an enrichment layer that appends firmographic and demographic data to existing records in real time. It’s particularly effective for inbound use cases—when someone visits your site or fills out a form, Clearbit automatically enriches that record with company details.

What Clearbit provides for account research:

- Real-time data enrichment through API and CRM integrations

- Automatic company and contact data appended to records

- Form shortening that captures less data while enriching more

- Visitor identification to understand which accounts are engaging

- Standardized data formatting that improves CRM hygiene

Where it fits in account research: Clearbit fills in data gaps and maintains CRM quality, but it doesn’t determine account readiness. It’s a hygiene and efficiency tool, not a qualification tool. For outbound account research, Clearbit ensures your records are complete and up-to-date, but it doesn’t evaluate whether an account meets your ICP or is ready for outreach. It assumes the targeting decision has already been made elsewhere.

Best for:

- Inbound-heavy teams needing automatic enrichment

- Organizations focused on CRM data quality

- Marketing and sales ops teams automating data workflows

LinkedIn Sales Navigator

Sales Navigator is a manual research tool built into LinkedIn’s network. It helps individual contributors investigate specific accounts, understand organizational structure, track job changes, and identify warm introduction paths.

What Sales Navigator provides for account research:

- Advanced search filters for finding accounts and contacts

- Organizational charts showing company structure and relationships

- Real-time alerts on job changes and company updates

- TeamLink for identifying mutual connections and warm paths

- Account recommendations based on your activity patterns

Where it fits in account research: Sales Navigator excels at deep, manual investigation of high-value accounts. It’s useful when you need to understand a specific company’s structure, decision-making process, or relationship network. What it doesn’t do is scale that research across your team or enforce consistent evaluation standards.

If ten reps are using Sales Navigator independently, you get ten different research processes with no way to ensure quality or consistency. It’s a powerful tool for individual contributors doing high-touch outreach, but it doesn’t solve the account-readiness problem for teams running scaled outbound motions.

Best for:

- Individual contributors researching strategic accounts

- Teams doing relationship-driven, high-touch outreach

- Account executives mapping organizational structures

Crunchbase

Crunchbase provides funding data, investor relationships, acquisition history, and company growth metrics. It’s valuable when funding signals correlate with buying intent—if you sell to venture-backed companies or track when accounts raise capital.

What Crunchbase provides for account research:

- Funding round data and investor tracking

- Acquisition history and M&A activity

- Employee count trends and growth indicators

- News alerts for company developments

- API access for integrating funding data into workflows

Where it fits in account research: Crunchbase adds context about a company’s financial position and growth trajectory. For teams where funding is a qualifying signal—like those selling to startups or high-growth companies—Crunchbase helps identify accounts showing readiness indicators. But it’s supplementary, not comprehensive. Crunchbase adds an important signal, but only when funding is part of your qualification logic. On its own, it can’t determine whether an account is actually ready for outbound.

Best for:

- Teams selling to venture-backed or high-growth companies

- Organizations using funding events as buying signals

- Sales teams tracking portfolio companies or investors

Apollo

Apollo combines contact data, enrichment, and email sequencing in a single platform. It’s designed for teams that want an all-in-one tool without complex integrations—you get data access, basic enrichment, and outreach automation in one interface.

What Apollo provides for account research:

- Contact database with email and phone access

- Firmographic and technographic filters for list building

- Built-in email sequencing and automation

- Chrome extension for prospecting while browsing

- Basic enrichment to fill in missing account details

Where it fits in account research: Apollo provides data and basic filtering capabilities, which helps with list building and initial targeting. The account research depth is limited compared to dedicated platforms—you can filter by firmographics and pull contact lists, but there’s no sophisticated qualification logic or readiness evaluation. It’s best for teams running straightforward, high-volume outbound where speed matters more than account-level precision. Apollo helps teams move fast, but it assumes the account is already worth targeting—the readiness decision still happens manually, if it happens at all.

Best for:

- Small to mid-sized teams wanting an all-in-one platform

- Organizations running high-volume outreach campaigns

- Teams that need to move quickly without complex setup

When Different Account Research Tools Make Sense

Use data providers and basic account research tools when:

- You are building initial account lists for outbound

- ICP criteria are still evolving

- Reps decide which accounts to work based on judgment

- B2B account research is focused on learning, not scale

Add account readiness and qualification tools when:

- Outbound volume increases and manual research can’t keep up

- Account quality varies by rep

- Sales teams question whether accounts should have been targeted

- You need consistent ICP qualification before outreach begins

Rely on manual sales account research tools when:

- Deal sizes are large and target lists are small

- Reps own full cycles and research accounts deeply

- Outbound account research is high-touch, not high-volume

- Consistency is less critical than depth

Standardize account research in B2B sales when:

- Accounts are assigned at scale

- RevOps defines targeting rules centrally

- Pipeline quality must be predictable

- Account readiness must be enforced, not optional

If pipeline quality is hard to explain, outbound performance varies by rep, or account fit is debated after outreach starts, manual account research has stopped scaling. That’s when account research tools need to move from data support to decision enforcement.

Account Research Tools Comparison

| Tool | Account Research Function | Provides Gatekeeping? | Scales Judgment? | Best for Teams That… |

|---|---|---|---|---|

| Pintel.AI | Enforces account-readiness before outbound | Yes—applies ICP criteria and qualification logic | Yes—standardizes research across all accounts | Need consistent qualification at scale |

| ZoomInfo | Provides data inputs for targeting decisions | No—supplies data, doesn’t evaluate readiness | No—requires external process | Need comprehensive contact and company data |

| Clearbit | Enriches records with firmographic data | No—hygiene layer, not qualification | No—maintains data, doesn’t assess fit | Prioritize CRM data quality and automation |

| LinkedIn Sales Navigator | Enables deep manual research | No—individual tool, no standardization | No—quality depends on user | Do high-touch, relationship-driven outreach |

| Crunchbase | Adds funding and growth context | No—supplementary signal source | No—manual lookup tool | Sell to venture-backed companies |

| Apollo | Combines data and outreach execution | No—filtering only, no qualification depth | Partial—workflows included but shallow | Want all-in-one simplicity over depth |

Choosing the Right Account Research Tools

By this stage, the issue should be clear: most teams don’t lack data, they lack a system that enforces targeting judgment before outbound begins.

Account research tools only solve this if they match the function you need. Data providers give you coverage. Enrichment layers maintain hygiene. Manual research tools support deep investigation. But none of these enforce account-readiness standards across your motion. For that, you need a platform designed to apply qualification logic systematically and deliver only accounts that meet your criteria.

If you’re scaling outbound and research consistency is breaking, adding more data tools won’t fix it. You need to standardize the judgment that happens before accounts enter workflows. That’s when account-readiness platforms become necessary—not as another data source, but as the system that enforces targeting discipline your team can’t maintain manually.

FAQ

What is an account research tool in B2B sales?

An account research tool helps sales teams evaluate whether a company should be targeted for outbound. It goes beyond finding contact information—it provides the data, signals, and context needed to determine if an account fits your ICP and is ready for outreach.

How is account research different from data enrichment?

Data enrichment fills in missing fields in your CRM—company size, industry, employee count. Account research determines whether an account should enter your outbound workflow in the first place. Enrichment assumes you’ve already decided to target the account; research makes that decision.

When do teams need an account-readiness platform?

When inconsistent account research starts affecting pipeline quality. If different reps apply different targeting standards, if account quality varies unpredictably, or if you’re scaling past the point where manual research can maintain consistency—that’s when enforcement layers become necessary.

Can data providers replace account research tools?

No. Data providers supply the raw information—firmographics, contacts, intent signals—but they don’t evaluate whether an account meets your criteria or is ready for outreach. They’re essential inputs, but they don’t make targeting decisions or enforce qualification standards.

What should you look for in account research tools?

The best account research tools enforce qualification logic systematically, not just provide more data. Look for tools that apply your ICP criteria automatically, aggregate data from multiple sources, evaluate readiness signals, and deliver pre-vetted accounts to your team. The goal is consistency in how accounts get qualified, not just access to more information.

How do account research tools improve pipeline quality?

Account research tools improve pipeline quality by standardizing the evaluation process before accounts enter your workflow. Instead of relying on individual reps to research and qualify accounts differently, these tools enforce consistent criteria across every account. This means sales teams spend time on accounts that actually fit your ICP, reducing wasted effort and improving conversion rates.