Sales teams want to move faster from identifying contacts to sending outreach. But the path from a defined ICP to a list of outreach-ready contacts still involves spreadsheets, disconnected tools, and manual work. This is where AI tools for finding contacts become critical.

Most GTM teams adopt AI expecting efficiency gains, but instead end up with tool sprawl—one platform for discovery, another for enrichment, a third for research, and a fourth for message prep. Each handoff adds friction, inconsistency, and cleanup work that often falls on RevOps.

This guide focuses on how AI tools for finding contacts support contact discovery, enrichment, and outreach preparation—the operational steps that happen before a sequence runs. It’s not a general comparison of AI platforms, but a practical breakdown of how AI-powered systems reduce manual work and help teams choose the right setup based on GTM maturity and workflow complexity.

What AI Does in Contact Finding and Outreach Preparation

AI tools for finding contacts surface people who match ICP criteria automatically and monitor accounts for changes. Instead of building lists from scratch each quarter, reps review net-new contacts as they join companies, get promoted, or become relevant based on role changes.

They do this by continuously pulling and reconciling data from multiple sources, rather than relying on a single static database. This allows systems to detect job changes, account shifts, and new buying committee members as they appear, not months later when databases refresh.

How AI Addresses Core Prospecting Bottlenecks

AI platforms address three core bottlenecks in outbound motion: finding the right contacts, ensuring data quality, and preparing personalized outreach at scale. Each stage has specific failure points that create manual work.

Contact Discovery

The manual problem: Traditional contact discovery involves reps searching LinkedIn Sales Navigator, exporting CSVs, and manually verifying contacts still work at their company. This doesn’t scale when targeting hundreds of accounts.

How AI tools for finding contacts solve it: AI systems continuously surface contacts that match ICP criteria and monitor accounts for changes. Instead of building lists from scratch each quarter, reps review net-new contacts as they join companies, get promoted, or become relevant based on role changes.

Why continuity matters: The difference between contact databases and AI-powered contact discovery is continuity. A database gives you a snapshot. AI tools for finding contacts track when people move, when companies raise funding that puts them in your target range, and when new decision-makers enter buying committees. For account-based motions, this timing matters for pipeline.

Enrichment

The data quality problem: Enrichment fills missing fields, normalizes inconsistent data, and reduces the spreadsheet work that follows every data import. The problem isn’t just missing emails or phone numbers—it’s inconsistent formatting (Director of Sales vs Sales Director), outdated job titles, duplicate records, and partial data that makes segmentation unreliable.

How AI automates cleanup: AI platforms automate this by pulling data from multiple providers, applying normalization rules, and filling gaps without manual intervention. Waterfall enrichment—trying one data source, then falling back to others if the first fails—ensures higher match rates across regions. This matters for teams prospecting globally where US-focused databases have poor coverage in EMEA or APAC.

The segmentation impact: Better enrichment means better segmentation. If job titles are standardized and seniority fields are accurate, reps can segment by persona and send relevant messaging instead of generic outreach. RevOps spends less time cleaning data and more time defining ICP logic that actually gets enforced.

Research and Personalization

The manual research bottleneck: Contact research tools pull signals like recent funding, hiring trends, tech stack changes, or leadership moves to inform outreach without requiring reps to manually research every account. The manual version involves reps checking company LinkedIn pages, reading recent news, and scanning websites for initiatives. At scale, this doesn’t happen. Reps skip research and send generic emails.

How AI surfaces relevant signals: AI platforms reduce this by automatically surfacing relevant signals and summarizing account context. Instead of “research 50 accounts,” the task becomes “review pre-pulled insights and decide which angle to lead with.” This works when the system understands what signals matter for your GTM motion—not just generic news, but specific triggers tied to how your product gets bought.

Example in practice: If you sell revenue intelligence software, knowing a company hired a new CRO matters more than knowing they raised a Series B. AI tools for personalized outreach that understand your ICP can prioritize the right signals and present them in a format that helps reps prep outreach quickly.

The consistency advantage: The workflow improvement isn’t just speed—it’s consistency. When research happens automatically and signals are surfaced systematically, personalization stops being something only your best reps do.

How Different AI Tools for Finding Contacts Fit the Workflow

Below are examples of platforms commonly used at different stages of the prospecting workflow—from finding sales contacts with AI through enrichment to outreach preparation. Each fits a different stage and GTM maturity level.

Understanding where each platform fits in the workflow helps GTM leaders avoid adopting systems that solve adjacent problems instead of the actual bottleneck. These aren’t presented as a ranked comparison, but as working examples of how different teams operationalize contact discovery and outreach prep.

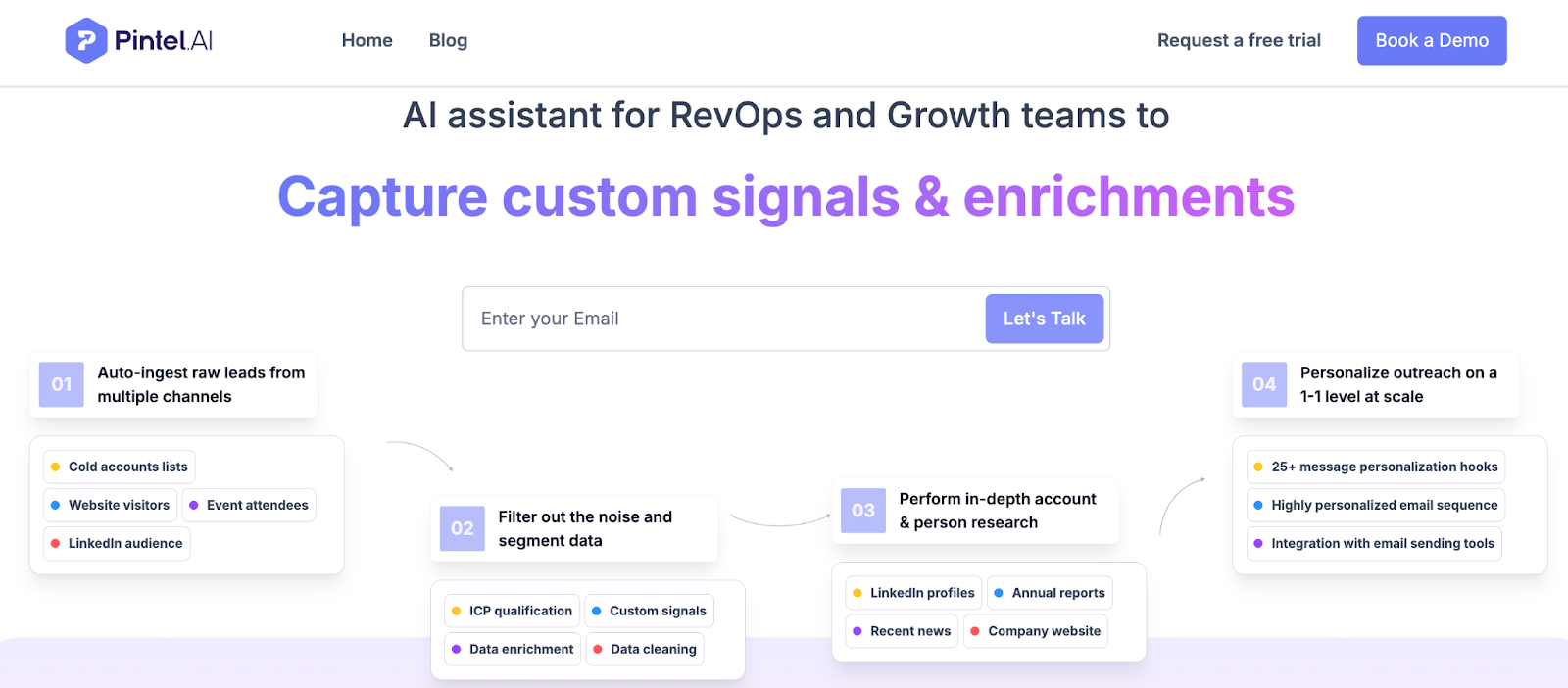

Pintel.AI

Pintel.AI connects contact discovery, enrichment, research, and segmentation in a single system instead of requiring RevOps to stitch tools together.

Best suited for: Mid-market and enterprise sales teams that know their ICP but struggle with execution consistency. Works well when RevOps wants centralized ICP logic and reps need contacts that are pre-qualified and research-ready without manual prospecting.

What it helps with:

Contact discovery: Monitors accounts continuously and surfaces contacts as they become relevant based on role changes, promotions, or hiring. Supports event-based prospecting by scraping speaker lists and attendee rosters, then enriching and applying ICP filters automatically.

Enrichment: Uses waterfall enrichment across multiple data providers for coverage in US, EMEA, and APAC without paying minimums to regional vendors separately. Each data point includes a confidence score so RevOps can review only low-confidence results instead of manually checking every row.

Research and personalization: Surfaces account signals and context directly alongside contact records. Supports persona segmentation and outreach prep without moving data between tools.

Workflow execution: Problem-led setup lets users describe what they need in natural language. Pintel recommends workflows automatically instead of requiring manual step-by-step design. Multi-agent AI architecture handles ICP filtering, account research, and QA as separate agents with embedded logic for edge cases.

Reduced manual work: Confidence scoring on outputs means teams review exceptions, not every cell. Built-in QA agent flags low-confidence data. Prompt templates guide users instead of requiring open-ended prompt engineering.

Tradeoffs / context:

- Earlier-stage product with a stronger focus on data coverage than brand presence.

- Relies on a large network of 150+ data providers rather than a single proprietary database.

- Opinionated system design that favors consistency over unlimited customization.

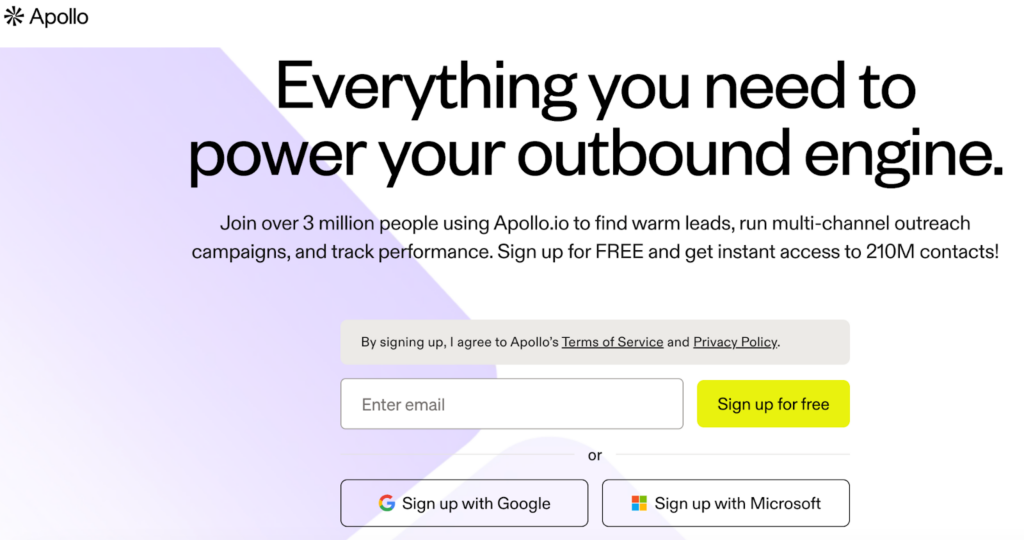

Apollo

Reader pain this tool addresses: Reps need a searchable database to find contacts and accounts without jumping between LinkedIn, ZoomInfo, and a CRM. Apollo consolidates contact discovery and basic enrichment in one interface.

Best suited for: Small to mid-sized sales teams that need a self-serve platform. Works well when reps own list building and outreach execution without heavy RevOps involvement.

What it helps with:

Contact discovery: Searchable B2B database with filters for title, seniority, industry, and company size

Enrichment: Fills email, phone, and LinkedIn profile data

Basic outreach: Built-in sequencing and email tracking

Tradeoffs / context:

- Data accuracy varies by region and company size. Enterprise contacts and non-US markets have lower coverage.

- ICP logic lives in saved searches, not enforced workflows. Reps can deviate from targeting criteria.

- Teams outgrow Apollo when they need deeper signal-based prospecting or when RevOps wants to centralize ICP definitions across tools.

Clay

Reader pain this tool addresses: RevOps and Sales Ops teams need flexibility to combine multiple data sources, run custom enrichment logic, and build complex workflows without engineering support. Clay is a spreadsheet-like interface for orchestrating AI sales workflow steps across vendors.

Best suited for: Teams with dedicated RevOps or Sales Ops headcount. Best for companies that already know their ICP well and need custom workflows to operationalize it.

What it helps with:

Enrichment: Pulls data from 50+ sources and applies conditional logic to prioritize the best result

Research and personalization: Chains AI prompts to summarize account context or generate message hooks

Custom workflows: Handles edge cases and multi-step processes that rigid platforms can’t support

Tradeoffs/context:

- Requires RevOps ownership. Reps won’t build Clay workflows themselves.

- No built-in contact discovery. You bring your own lists or connect to databases like Apollo.

- High flexibility means high maintenance. Workflows break when data sources change or APIs update.

- Teams outgrow Clay when they need a system that runs consistently without constant RevOps intervention.

Clearbit

Reader pain this tool addresses: Marketing and RevOps teams need real-time enrichment for inbound leads and CRM records without manual CSV uploads. Clearbit automates enrichment at the point of capture.

Best suited for: Inbound-heavy teams or companies where RevOps owns data quality. Works best when enrichment needs to happen automatically, not as a rep-initiated task.

What it helps with:

Enrichment: Appends firmographic, technographic, and contact data to CRM records in real time

Form enrichment: Captures additional data from inbound form fills without adding friction

Tradeoffs/context:

- Not built for outbound list building. Clearbit enriches records you already have, but doesn’t help reps discover new contacts.

- Teams using Clearbit still need a separate platform for contact discovery and prospecting.

- Pricing is based on API calls, so high-volume outbound motions can get expensive.

Choosing the Right Setup for Contact Discovery and Outreach Preparation

Most purchasing mistakes happen when teams evaluate platforms in isolation instead of mapping them to how their GTM motion actually runs. The decision isn’t which platform has the best features—it’s which one matches your ownership model, workflow complexity, and operational capacity.

1. Who Owns Prospecting: Reps vs RevOps

Ownership determines whether a platform gets adopted or becomes shelfware.

Rep-owned prospecting works when your ICP is simple, your market is well-defined, and reps have time to build their own lists. Self-serve platforms like Apollo fit here because reps can search, filter, and export without dependencies. The tradeoff: inconsistency. Each rep interprets ICP criteria differently, and there’s no enforcement layer.

RevOps-owned prospecting works when ICP definitions are complex, when you’re running account-based motions, or when data quality directly impacts conversion rates. Systems that enforce ICP logic and surface pre-qualified contacts reduce wasted rep time on out-of-scope accounts. The tradeoff: RevOps becomes a bottleneck if the system requires constant workflow adjustments.

The failure mode is adopting a platform that doesn’t match who does the work. If you buy a RevOps-heavy system but expect reps to operate it, adoption fails.

2. Workflow Complexity: Simple Outbound vs Multi-Step GTM

Simple outbound motions—one ICP, one persona, one message—don’t need complex AI platforms. Multi-step workflows—account research, signal-based prospecting, persona segmentation, custom messaging—break in simple systems.

Simple workflow example: “Find VPs at Series B SaaS companies and send a cold email.” A contact database with basic filters works. You don’t need multi-agent systems or automated research.

Complex workflow example: “Identify accounts showing buying intent, find multiple personas within the buying committee, surface account-specific pain points, segment by persona, and prep personalized messaging.” This needs a system that handles complexity without requiring RevOps to manually chain steps together.

The mistake teams make is underestimating workflow complexity when evaluating platforms. What feels like “just find me contacts” often involves hidden steps: verifying data accuracy, segmenting by persona, researching account context, and ensuring ICP compliance. If those steps aren’t accounted for in the platform decision, they become manual work.

3. Data Quality Requirements: When Accuracy Matters

Basic enrichment fills missing fields. High-accuracy enrichment validates data, scores confidence, and flags inconsistencies. The difference matters when bad data costs you deliverability or wastes rep time.

High-volume, low-touch outbound: A 70% contact accuracy rate is acceptable. Basic enrichment is enough. Volume compensates for inaccuracy.

Account-based sales or executive outreach: Each contact matters. Systems that provide confidence scores, validate emails before sending, and normalize data across sources reduce waste.

Data quality requirements should map to your outbound volume and deal size. High-volume, transactional sales can tolerate more inaccuracy. Low-volume, high-ACV sales cannot.

The operational cost of bad data isn’t just bounced emails. It’s reps researching contacts that don’t exist, RevOps cleaning lists after the fact, and sequences that burn through accounts without generating pipeline.

4. Scale and Maintenance Overhead

When evaluating AI platforms, small teams need systems that work out of the box. Scaling teams need systems that don’t break as volume increases.

For small teams without dedicated RevOps or Sales Ops: Maintenance overhead is the hidden cost. Platforms that require ongoing workflow adjustments, prompt tuning, or manual data validation create dependencies. If the system breaks and there’s no one to fix it, prospecting stops.

For scaling teams: Can the platform handle 10x the volume without 10x the maintenance? Can it process thousands of contacts per week without requiring manual review? Does it degrade as data sources change or as workflows get more complex?

Point solutions tend to scale vertically—they handle one task well but don’t reduce the number of tools in the stack. Unified systems scale horizontally—they handle more of the workflow but require upfront setup.

How All the Pieces Fit Together

Choosing the right setup for finding sales contacts with AI and preparing outreach comes down to three factors: who owns prospecting, how complex your workflows are, and whether your biggest bottleneck is functionality or execution.

Teams run into trouble when platforms are adopted without clarity on ownership or workflow design. The result is tool sprawl, manual handoffs, and RevOps spending more time maintaining integrations than improving strategy. The platforms themselves may work, but the prospecting motion does not improve.

GTM maturity plays a big role in platform fit. Early-stage teams benefit from self-serve systems that work immediately. Scaling teams need platforms that enforce ICP logic and reduce manual work. Enterprise teams need systems that can handle complexity without requiring constant operational intervention.

Evaluate AI platforms based on whether they reduce handoffs, match how your team actually works, and scale without adding maintenance overhead. The goal is not to assemble the largest stack, but to build a prospecting workflow that runs consistently and supports pipeline growth.

Frequently Asked Questions

How do I know if my current setup is actually helping or just adding complexity?

If your team still exports CSVs, manually checks data accuracy, or moves information between tools before outreach, the platforms are likely adding complexity. A useful signal is handoffs. The more times data changes systems before a rep can send outreach, the more friction your stack is creating instead of removing. Effective AI tools for finding contacts should reduce these handoffs, not create new ones.

Can AI tools for finding contacts work if our ICP is still evolving?

Yes, but only platforms that allow ICP logic to be adjusted without rebuilding workflows. When ICPs change frequently, rigid systems create rework. The best AI tools for finding contacts separate targeting logic from execution, making it easier to update criteria without breaking prospecting processes.

What is the biggest mistake teams make when adopting AI platforms for prospecting?

The most common mistake is evaluating platforms in isolation instead of mapping them to the full prospecting workflow. Teams often buy systems to solve symptoms like slow list building without addressing upstream problems like unclear ownership, inconsistent data standards, or lack of enforced ICP rules.

Do AI tools for finding contacts require clean data to work well?

AI tools for finding contacts do not require perfect data, but they do require consistent data. Inconsistent fields, mismatched job titles, or unclear source priority reduce effectiveness. Systems that validate, normalize, and flag low-confidence data perform better than those that simply append fields.

How much setup time should teams realistically expect?

Setup time varies widely. Self-serve platforms can be used the same day but often require ongoing manual effort. More structured systems may take a few weeks to define ICP logic and workflows, but typically reduce daily manual work afterward. The key is whether setup reduces or shifts effort.

Will AI platforms for contact discovery change how SDRs and BDRs are measured?

Over time, yes. As AI tools for finding contacts eliminate manual research and list building, activity-based metrics become less meaningful. Teams often shift toward measuring conversion quality, response rates, and meeting relevance instead of volume-based KPIs.

How should teams think about replacing versus layering AI platforms?

If a new platform requires copying data from existing systems, it is layering. Replacement happens when a platform removes an entire step or vendor from the workflow. Replacement reduces cognitive load, while layering increases it even if individual platforms are powerful.

Are AI platforms for finding contacts more useful for early-stage or scaling teams?

Scaling teams tend to benefit more from AI tools for finding contacts because workflow complexity increases with volume, regions, and personas. Early-stage teams can succeed with simpler platforms, but often adopt AI systems later to enforce consistency and reduce manual effort as they grow.

What should teams clarify internally before evaluating platforms?

Teams should agree on who owns prospecting, how strict ICP enforcement needs to be, and how much manual maintenance they can support. Without alignment on these questions, even strong platforms fail to deliver value.

How do I explain the ROI of AI tools for finding contacts to leadership?

ROI is best framed in terms of reduced wasted effort rather than increased output. When evaluating AI tools for finding contacts, focus on time saved on manual research, fewer bad contacts entering sequences, and more consistent targeting. These improvements often deliver more value than raw activity increases.