ZoomInfo has long been the default choice for B2B teams that need fast access to contact information. Its core strength lies in email and phone data coverage, making it a foundational tool for outbound prospecting—especially in the early stages of a GTM motion. For many organizations, ZoomInfo is what enables outbound to scale beyond manual research.

As GTM operations mature, however, the challenge shifts. Teams start to feel friction that isn’t about missing contacts, but about how enrichment behaves once it enters live systems. Titles change between cycles, seniority mappings drift, routing and scoring logic becomes harder to trust, and SDRs begin re-validating data manually. At the same time, seat-based pricing and forced email-plus-phone bundling drive costs up without reducing personalization or research effort.

This guide examines the ZoomInfo alternatives GTM teams evaluate when access is no longer the constraint. It breaks down how each platform approaches data accuracy, pricing, and operational fit, and where those differences matter in real GTM workflows.

The goal is not to rank tools, but to help revenue leaders understand which solutions align with their stage, motion, and tolerance for manual overhead as they scale.

What Are ZoomInfo Alternatives?

ZoomInfo alternatives are data platforms that GTM teams evaluate when access to contacts is no longer the problem, but data reliability, cost, and operational efficiency are.

Teams typically start evaluating alternatives when:

Operational complexity outgrows what a single-database provider can handle reliably

Data quality becomes inconsistent across enrichment cycles

CRM workflows break due to classification drift

Costs scale faster than value

Comprehensive Comparison: Top ZoomInfo Alternatives in 2026

Before we dive deep into individual platforms, understanding how the leading ZoomInfo alternatives differ at a strategic level helps organizations quickly identify which solutions deserve closer evaluation.

| Platform | Primary Strength | Ideal Team Profile | Key Differentiator |

|---|---|---|---|

| Pintel | Accuracy-first enrichment + AI research | Teams needing stable qualification logic | Maintains classification consistency across cycles |

| Apollo | Database + outbound execution | High-volume prospecting operations | All-in-one platform reducing tool proliferation |

| Clay | Data orchestration | Technical teams wanting customization | Maximum flexibility across multiple sources |

| Clearbit | Firmographic enrichment | Account-focused segmentation | Company data specialization and depth |

| Cognism | Compliance-first data | EMEA and regulated markets | GDPR-aligned sourcing with transparency |

| Lusha | Lightweight contact discovery | SMB and individual prospectors | Simplicity and minimal setup requirements |

| Seamless.ai | Rapid list expansion | Volume-driven prospecting | Real-time contact sourcing at scale |

Note: This comparison is based on commonly observed GTM use cases, product documentation, and publicly available customer feedback.

Now let’s explore each platform in detail so GTM leaders can understand not just what they do, but whether they solve the specific constraint their organization is facing.

Deep Dive: Leading ZoomInfo Alternatives

An operational comparison of leading platforms and how their data models behave inside real GTM workflows.

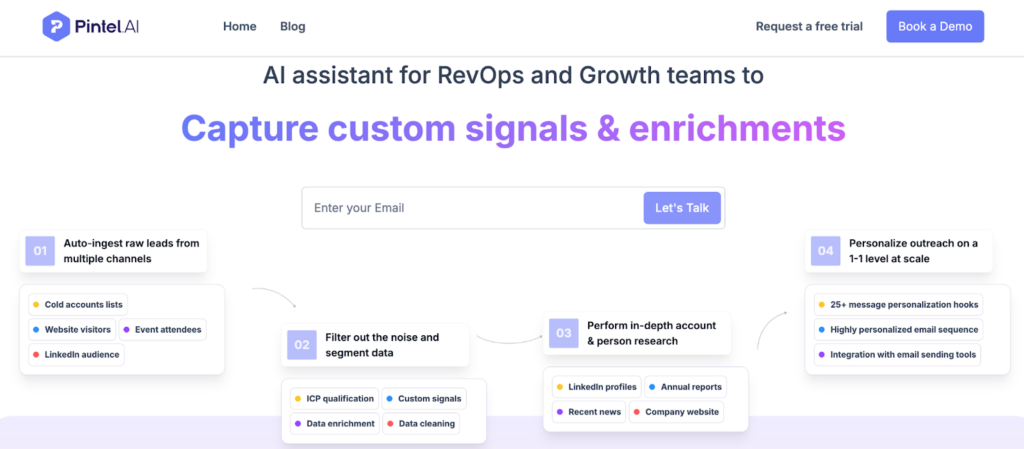

Pintel: The Accuracy-First ZoomInfo Alternative

What Makes Pintel Different

Pintel.AI is built for GTM teams that want more than basic contact details. While most ZoomInfo alternatives focus on expanding email and phone coverage, Pintel focuses on delivering reliable context around roles, seniority, and buying relevance.

That context is designed to remain consistent as it moves from research into execution, so routing, scoring, and qualification logic continue to work predictably as teams scale.

Key Features:

- Stable persona classification that doesn’t shift between enrichment cycles

- Consistent function mapping and predictable seniority categorization

- Multi-layer lead enrichment reduces dependence on single data sources

- AI-generated research context explaining why leads qualify for outreach

- Controlled enrichment that preserves consistency rather than aggressive overwrites

- Unlike single-database platforms, Pintel’s waterfall enrichment model pulls from multiple regional and vertical-specific sources, extending coverage beyond SaaS-heavy datasets

Operational Benefits:

- In production workflows, routing rules and lead scoring models behave predictably without constant recalibration

- CRM workflows operate smoothly without unexpected disruptions

- SDRs reduce data validation and stay focused on their prospecting workflow

- RevOps teams avoid constant firefighting over data conflicts

When Teams Choose Pintel

Organizations select Pintel as their ZoomInfo competitor when data looks complete on the surface but fails to behave reliably in live workflows—a pattern RevOps teams often see in environments where data trust directly impacts forecast accuracy.

Best for: Mid-market to enterprise B2B companies, organizations with mature RevOps functions, teams prioritizing qualification accuracy over raw volume, and companies where data reliability directly impacts pipeline predictability.

ZoomInfo vs Pintel: Understanding the Core Difference

ZoomInfo is built to maximize access to contact data. Pintel is built to ensure that data remains reliable once it enters live GTM workflows.

One optimizes for who you can reach.

The other optimizes for whether your systems still work after enrichment.

This isn’t about features—it’s about data philosophy. ZoomInfo prioritizes breadth. Pintel prioritizes behavior. For teams where classification stability determines pipeline predictability, that difference becomes everything.

Having established how Pintel addresses the accuracy and stability challenge, let’s examine alternatives that optimize for different constraints.

Apollo: The All-in-One ZoomInfo Alternative

What Makes Apollo Different

Apollo combines data access and outbound execution in a single platform, eliminating the need to switch between multiple tools.

Key Features:

- Extensive contact database with integrated sequencing and dialer

- Native email functionality and outreach automation

- Built-in filters for company size, industry, and tech stack

Operational Benefits:

- SDRs move seamlessly from list building to active outreach

- Reduced tool proliferation and simplified tech stack

- Fast time-to-first-touch for high-velocity motions

The Tradeoff: Teams accept variability in enrichment depth and classification stability in exchange for operational speed and cost efficiency.

Best for: High-velocity SDR teams, startups building their outbound motion, and organizations wanting to consolidate their sales tech stack.

Clay: The Flexible ZoomInfo Alternative

What Makes Clay Different

Clay functions as a data orchestration layer rather than providing a single proprietary dataset, giving technical teams complete control over their enrichment logic.

Key Features:

- Connects multiple data providers (ZoomInfo, Clearbit, Apollo, and more)

- Custom enrichment workflows tailored to specific requirements

- Waterfall enrichment trying multiple sources sequentially

- Sophisticated data transformations before CRM sync

- Custom validation rules across multiple providers

Operational Benefits:

- Maximum flexibility for teams with unusual requirements

- Ability to combine best-in-class sources strategically

- Advanced use cases like multi-source validation

- Complete control over data quality logic

The Tradeoff:

Clay shifts responsibility for data quality from the vendor to your internal team, requiring dedicated resources for monitoring, optimization, and troubleshooting.

Best for: Technically sophisticated GTM teams, organizations with dedicated RevOps personnel, companies requiring custom enrichment logic, and teams wanting to combine multiple data sources strategically.

Clearbit: The Firmographic-Focused ZoomInfo Alternative

What Makes Clearbit Different

Clearbit specializes in company-level enrichment and technographic intelligence rather than focusing on individual contact discovery.

Key Features:

- Deep firmographic data (employee count, revenue, funding)

- Technographic intelligence (technology stack details)

- Strong CRM and marketing automation integration

- Website visitor identification (Clearbit Reveal)

- Industry classifications and company attributes

Operational Benefits:

- Fast account-level segmentation and routing

- Excellent for account-based marketing strategies

- Clean integration with existing tech stacks

- Real-time company data updates

Common Use Case:

Clearbit is typically deployed as a complementary tool within a broader data stack rather than as a complete ZoomInfo competitor handling all enrichment needs.

Best for: Account-based marketing teams, organizations prioritizing firmographic intelligence over contact volume, marketing operations teams doing account segmentation, and companies with strong inbound motion needing visitor identification.

One Common Question We Get:

Q: We already have contact details. How do we get more useful data?

A: Teams get that data by using an enrichment and research automation tool, not by adding more raw fields.

As GTM motions mature, the challenge shifts from collecting contact details to understanding who the buyer is, why they qualify, and how that information behaves inside routing, scoring, and outreach workflows. Enrichment and research automation provide structured role classification, seniority mapping, firmographic context, and supporting research so systems work predictably without constant manual validation.

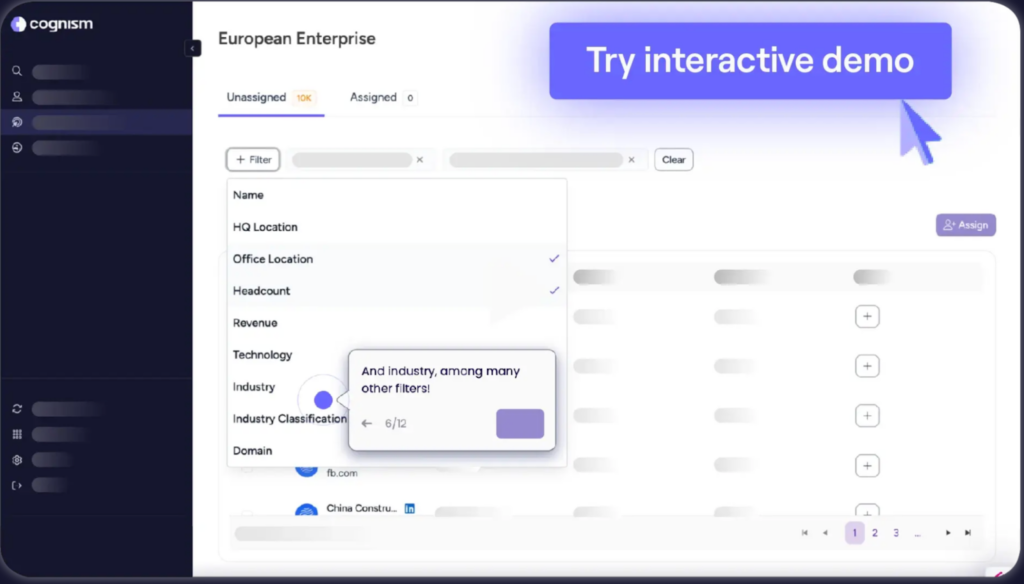

Cognism: The Compliance-First ZoomInfo Alternative

What Makes Cognism Different

Cognism prioritizes regulatory compliance and transparent data sourcing, making it ideal for European markets and regulated industries.

Key Features:

- Strong GDPR alignment and compliance-first sourcing

- Robust EMEA market coverage

- Transparent data provenance documentation

- “Diamond Data” tier with verified cell phone numbers

- Opt-in based mobile number collection

Operational Benefits:

- Reduces legal risk for regulated industries

- Peace of mind around data sourcing practices

- Audit-ready documentation

- Verified contact information for compliance-sensitive outreach

Regional Strength:

Particularly strong for teams operating in Europe where GDPR compliance is non-negotiable.

Best for: European companies or those selling primarily into EMEA markets, regulated industries including finance and healthcare, organizations with strict data compliance requirements, and companies prioritizing verified mobile numbers.

Lusha: The Lightweight ZoomInfo Alternative

What Makes Lusha Different

Lusha focuses on simplicity and ease of use for SMB teams and individual contributors who need quick contact data access.

Key Features:

- Browser-based Chrome extension for quick prospecting

- Minimal technical setup with straightforward pricing

- Fast implementation with low learning curve

Operational Benefits:

- Immediate time-to-value without complex workflows

- Accessible pricing for small teams

- Simple interface without enterprise complexity

The Tradeoff: Limited enrichment depth and minimal governance controls compared to enterprise platforms.

Best for: SMB sales teams, individual contributors, and organizations with straightforward prospecting needs.

Seamless.ai: The Volume-Focused ZoomInfo Alternative

What Makes Seamless.ai Different

Seamless.ai prioritizes rapid contact discovery and aggressive list expansion for volume-based prospecting.

Key Features:

- Real-time sourcing and AI-assisted contact discovery

- “Unlimited” contact access on certain pricing tiers

- Rapid list building across market segments

Operational Benefits:

- High-volume prospecting support

- Fast list expansion capabilities

- Access to contacts not in curated databases

The Tradeoff: Greater variability in data accuracy and classification stability, though data freshness tends to be high.

Best for: Volume-driven outbound teams, organizations testing multiple market segments, and teams with high data consumption needs.

Now that you understand how each platform approaches the data challenge differently, let’s establish a systematic framework for evaluating which solution actually solves your specific constraint.

How to Choose the Right ZoomInfo Alternative: A Decision Framework

Selecting the optimal ZoomInfo competitor requires moving beyond feature checklists and focusing on your specific operational constraints and GTM maturity level.

Step 1: Identify Your Primary Bottleneck

Before comparing platforms, teams should clearly articulate what’s actually slowing their revenue motion down today.

If SDRs struggle to move quickly from list building to outreach, your constraint is speed and access. Consider Apollo or Seamless.ai. If data looks complete but behaves inconsistently in your CRM, your constraint is accuracy and stability—evaluate Pintel. If enrichment outputs vary by segment, your constraint is flexibility—look at Clay. If regulatory compliance is blocking data usage, consider Cognism.

The right solution solves your dominant constraint effectively rather than attempting to be adequate across all dimensions.

Step 2: Decide What Matters More—Speed or Stability

Different platforms optimize for fundamentally different outcomes. If your outbound motion depends on high-volume activity, prioritize speed and accept that classification may shift over time. If your workflows depend on clean routing and scoring logic, prioritize stability and controlled enrichment.

This tradeoff reflects fundamental architectural decisions each platform makes. Understanding which side of this spectrum your organization needs is critical for long-term satisfaction.

Step 3: Evaluate How Data Behaves After Enrichment

Most teams make evaluation decisions based on what data looks like at initial ingestion. This is a mistake. Instead, organizations should assess whether titles and seniority remain consistent across multiple enrichment cycles, whether enrichment unexpectedly overwrites existing CRM fields, whether qualification logic still works after repeated runs, and how the platform handles conflicting data.

A data platform that produces stable, predictable outputs over time is exponentially more valuable than one that looks impressive on day one but creates operational chaos as you scale.

Step 4: Account for Operational Overhead

Every data platform introduces maintenance overhead that rarely appears in stated pricing but significantly impacts total cost of ownership. GTM leaders should ask: How much manual validation will SDRs still need to perform? Will RevOps need to manage enrichment precedence and field conflicts? How often will workflows require adjustment? What technical resources are needed for implementation and ongoing optimization?

A platform that appears affordable upfront can become expensive once organizations factor in SDR validation time, RevOps bandwidth, and technical maintenance requirements.

Step 5: Align the Tool With Your GTM Maturity

Early-stage teams and mature revenue organizations have fundamentally different data requirements.

Early-stage GTM motion: Prioritize speed and coverage over perfect accuracy. Accept higher manual validation for lower cost. Best fit: Apollo, Lusha, Seamless.ai.

Growth-stage GTM motion: Balance speed with increasing need for consistency. Begin implementing formal RevOps processes. Best fit: Apollo, Pintel, Cognism.

Mature GTM motion: Prioritize data trust and operational predictability. Require stable classification for sophisticated routing and scoring. Best fit: Pintel, Clay (with dedicated resources), Cognism.

Choose a data provider that matches where your GTM motion exists today, not where you aspire for it to be eventually.

Even with a solid framework, teams commonly make predictable mistakes during evaluation. Let’s examine these pitfalls so organizations can avoid them.

Common Mistakes When Evaluating ZoomInfo Alternatives

Mistake #1: Assuming All Alternatives Solve the Same Problem

Treating all ZoomInfo alternatives as interchangeable and evaluating primarily on price or database size without understanding the underlying data philosophy. Some platforms optimize for volume, others for flexibility, others for accuracy, and others for compliance. Each has a distinct philosophy that drives different outcomes.

How to avoid it: Define your primary constraint first, then evaluate only providers specifically designed to solve that particular problem.

Mistake #2: Optimizing for Cost Instead of Operational Impact

Selecting the lowest-cost solution without modeling total cost of ownership. Lower subscription costs can be misleading when SDRs spend more time validating data or RevOps spends more time fixing CRM conflicts.

How to avoid it: At scale, organizations encounter the need to calculate total cost, including SDR validation time, RevOps bandwidth, and potential revenue impact from data quality issues.

Mistake #3: Ignoring Post-Enrichment Data Behaviour

Evaluating platforms based on initial field completeness without testing how data behaves over multiple enrichment cycles. Most data quality issues emerge after multiple cycles when classification drift and field conflicts accumulate.

How to avoid it: Test how data behaves across repeated enrichment cycles. Request to see how providers handle updates and maintain classification stability over 60-90 days.

Mistake #4: Overlooking CRM and Workflow Alignment

Choosing a data provider without understanding how it will interact with your existing CRM schema, field precedence rules, and downstream workflows.

How to avoid it: Map out your critical CRM workflows before evaluation. Test how each solution handles field updates, respects precedence rules, and integrates with your specific CRM configuration.

Mistake #5: Expecting One Tool to Replace Your Entire Data Stack

Believing a single platform will solve contact discovery, enrichment, research, intent data, and governance needs across all use cases. Most mature GTM teams use a combination of specialized tools.

How to avoid it: Define which specific jobs you need the provider to perform, and accept that you may need complementary tools for other aspects of your data strategy.

Final Takeaway: Choosing Your ZoomInfo Alternative

Evaluating ZoomInfo alternatives is rarely about dissatisfaction with ZoomInfo itself. More often, it signals that your outbound motion has matured and that data reliability—not access or coverage—has become your limiting factor for continued growth.

As teams scale from early prospecting to sophisticated revenue operations, the fundamental question shifts from “How many contacts can we reach?” to “Can we trust the data driving our routing, qualification, and outreach without constant manual correction?”

When data behaves unpredictably, every downstream system absorbs the cost: CRM logic breaks unexpectedly, SDR productivity drops as validation time increases, scoring models misfire and route leads incorrectly, and pipeline predictability suffers. The operational impact of inconsistent data becomes exponentially more expensive than any platform subscription fee.

Choose your ZoomInfo competitor based on your dominant operational constraint:

- Speed and volume: Pintel, Apollo and Seamless.ai deliver rapid access with integrated execution tools

- Accuracy and stability: Pintel provides classification consistency and enrichment discipline

- Flexibility and customization: Clay offers maximum control for technical teams

- Compliance and regional coverage: Cognism delivers regulatory alignment

- Simplicity and cost: Lusha and Apollo provide straightforward solutions at accessible prices